Institutional top of mind | #3

Keep up with the top industry updates as we present bi-weekly market insights that are important to traders in the institutional space.

This week, Kelvin Lam, CFA, Head of Institutional Research for OKX, looks at one top-of-mind issue in this installment: How the tightening of the US money supply continues to hamper liquidity in the digital assets space.

Top of mind: why a crypto bull market is on pause - for now

TL;DR

All eyes were on Federal Reserve Chair Jerome Powell's speech at the annual Jackson Hole Symposium, where he stated that "inflation remains too high" and the Fed is "prepared to raise rates further if appropriate". In the post-Covid era, global quantitative tightening measures undertaken by central banks have led to a contraction in the money supply M2 (white line in the graph below). The US money supply is shrinking for the first time since 1949 (Source: Federal Reserve). This tightening liquidity environment poses challenges for financial markets and the price of cryptocurrencies. While the market focuses on catalysts like Bitcoin spot ETF approval and Bitcoin halving potentially sparking a new bull run, it's crucial to track the global money supply (M2) as a key signpost. Historical data reveals a strong correlation of 0.85+ between the BTC price (gray line) and the money supply (white line) over the past decade. Staying attuned to global liquidity dynamics has become of utmost importance, yet it's often overlooked.

Source: TradingView

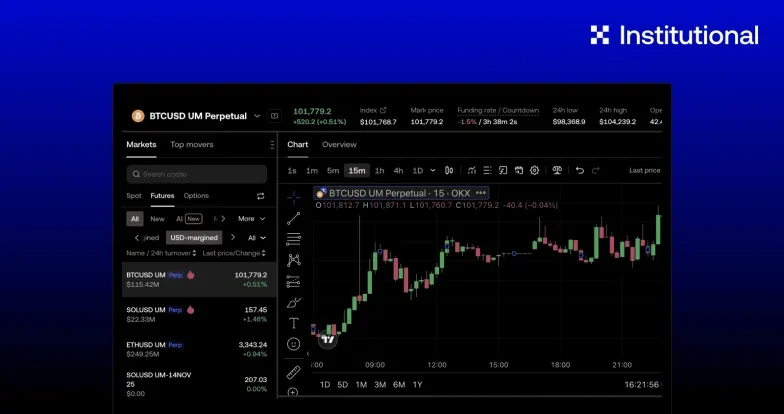

Undoubtedly, the tightening of the money supply has made its presence felt within the digital asset space, manifesting significant ramifications across multiple dimensions. The chart below includes some key indicators for gauging the liquidity situation in the cryptocurrency market.

Source: CryptoQuant, DefiLlama

The Federal Reserve in the US has been actively implementing quantitative tightening (QT) since June 2022, resulting in a reduction of its assets by $757 billion (Source: Federal Reserve Bank of St. Louis). If the QT continues at this accelerated pace, the Fed will soon need to slow or stop to avoid draining too many reserves from the banking system, due to how the QT program works by design. An update on the pace of QT could potentially be announced during the upcoming Fed meeting in September. Additionally, China has recently announced a series of policy-easing measures to bolster its economic recovery, while economic data in the eurozone is exerting pressure on the European Central Bank (ECB) to curtail further increases in borrowing costs. These factors contribute to a growing likelihood of a global money supply rebounding by the end of the year. In the meantime, the consequential impacts on the cryptocurrency markets can be closely tracked by the liquidity indicators stated above.

© 2025 OKX. Anda boleh memproduksi ulang atau mendistribusikan artikel ini secara keseluruhan atau menggunakan kutipan 100 kata atau kurang untuk tujuan nonkomersial. Setiap reproduksi atau distribusi dari seluruh artikel juga harus disertai pernyataan jelas: “Artikel ini © 2025 OKX dan digunakan dengan izin.“ Petikan yang diizinkan harus mengutip nama artikel dan menyertakan atribusi, misalnya “Nama Artikel, [nama penulis jika ada], © 2025 OKX.“ Beberapa konten mungkin dibuat atau dibantu oleh alat kecerdasan buatan (AI). Tidak ada karya turunan atau penggunaan lain dari artikel ini yang diizinkan.