Forced Loan Repayment, Credit Line Liquidation and Risk Unit Terms and Conditions

1. Risk Units Overview

Prior to being granted a loan or line of credit for the products/services described below, borrowers must nominate their main account and any number of sub-accounts (or no sub-accounts) to form a cluster called a Risk Unit. In the absence of a selection of Risk Unit composition, the Main and all eligible sub-accounts are selected to form the Risk Unit. OKX monitors the overall risk level of the loan or line of credit by reference only to the Risk Unit. Margin Ratios are calculated by reference to the assets in the Risk Unit.

Borrowers are responsible for managing the risk levels of the accounts within their Risk Unit.

The composition of a Risk Unit can be changed at any time, provided the MR% (as defined below) meets required thresholds.

2. Application

As at the date of publication of this article, the mechanisms referred to in this document apply to the following products / services, which may be updated by OKX at any time at its sole discretion:

Product / Service Name | Current Status |

Credit Line | ✅ |

Institutional Loan | ✅ |

3. Nominating a Risk Unit

Borrowers can nominate the accounts which would form a Risk Unit by informing their OKX account manager / business development representative directly.

Currently, only "Standard" and "Managed Trading" sub-accounts can be added to a Risk Unit. Other types of sub-accounts are not eligible to be added as sub-accounts. In the event that the selected accounts have any position open in any of the Structured Products, Trading Bots, or Copy Trading product lines, those accounts cannot be added to a Risk Unit. Further, once any account forms part of a Risk Unit, no new position can be opened in the above-mentioned products, or in the Simple Earn, Onchain Earn, Jumpstart, or Flexible Crypto Loan products.

By default, each Risk Unit must include one and only one main account.

In the absence of a selection of Risk Unit composition, the Main and all eligible sub-accounts are selected to form the Risk Unit.

OKX reserves the right to change the eligibility of account types to be part of a Risk Unit at its sole discretion.

4. Forced Loan Repayment / Credit Line Liquidation Mechanism

Margin Ratio

The risk monitoring mechanism for a Risk Unit works by reference to a margin ratio percentage (MR%).

Concept | Description | Example |

MR% | Borrowers should proactively assess the risk level and debt repayment ability of accounts / sub-accounts within the Risk Unit, by reference to MR%.

| Using the examples in the rows below: Total Discounted Assets of the Risk Unit = 7,276,250 + 5,000,000 = 12,276,250 Total Liabilities of the Risk Unit = 40 * 100,000 + 3,000,000 = 7,000,000 MR% = (12,276,250 - 7,000,000)/7,000,000 = 75.375% |

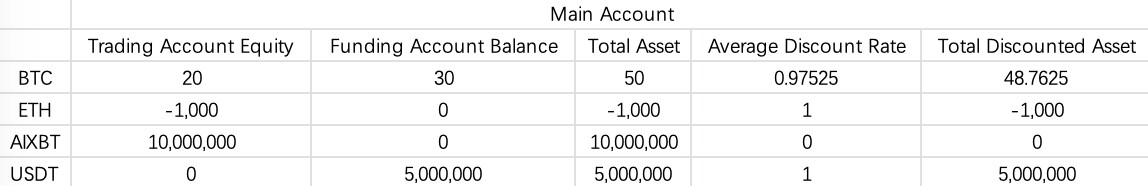

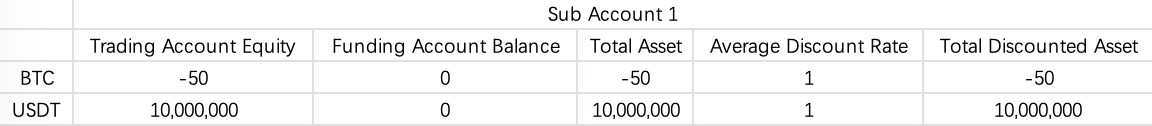

Total Discounted Assets of the Risk Unit | The sum of the discounted assets of each account / sub-account within the Risk Unit. Calculation of Total Discounted Assets: 1. Calculate the sum of each asset in each account / sub-account (inclusive of trading and funding accounts). 2. Multiply the above sum by a Discount Rate and Tier, applicable to each type of asset. Note that if the above figure for any asset is negative, then the full negative value is used for the purpose of the current calculation (i.e. the negative value is not discounted) 3. Convert the result for each type of asset to USDT 4. Calculate the sum of the abovementioned discounted assets Note that any assets in isolated-margin in long option positions are excluded from the Total Discounted Assets calculation. | Note: Kindly refer to the [Image 1] and [Image 2] below For the purpose of this example, assume current value of BTC is 100,000, current value of ETH is 2,600. Discounted asset value of Main Account (in USDT value): Discounted asset value of Sub-account 1 (in USDT value): Total Discounted asset value of the Risk Unit: |

Total Liabilities of the Risk Unit | Sum of all liabilities in the Risk Unit. For loans, liabilities takes into account principal, interest, and any other amounts owed. | Client borrows through Credit Line and Institutional Loan products:

= (40 * 100,000) + 3,000,000 = 7,000,000 |

[Image 1]

[Image 2]

Note: For Fiat, we support "EUR" and "USD" as collateral to calculate discount asset value into MR% for corresponding entity.

OKX are planning to iterate more fiats as collateral and liability in the future.

Liquidation process of fiat is the same as other crypto currency, following the forced loan repayment mechanism.

Risk management

MR% = 40% | This is the minimum Initial Margin Ratio (IMR) to open loan positions. |

If MR% is equal to or less than 40% | Assets cannot be withdrawn from or transferred out of the Risk Unit |

If MR% is equal to or less than 30% | This will trigger a Margin call, as described in the OKX Terms of Service. If Borrower does not respond to a Margin call and the request to top-up within 24hours of the Margin call, the accounts within the Risk Unit may be be liquidated. |

If MR% is equal to or less than 17% | This will trigger a liquidating warning. |

If MR% is equal to or less than 15% | Assets will be liquidated to bring reduce the Total Liabilities of the Risk Unit to zero, or until no further assets remain within the Risk Unit for liquidation. |

The above rules apply unless otherwise stated in any agreement between you and OKX.

For Institutional Loan borrowers, MR% can be viewed on the OKX Platform.

For API users using Credit Line, users can query the MR% through the API interface (API details provided on request of existing Credit Line users).

Note: Discount Rate refers to the value attributed to an asset (including fiat and digital asset) when used as collateral. It is specified here and can vary based on quantity (this being the Discount Tier). OKX reserves the right to adjust the Discount Rate and Tier based on prevailing market conditions, without prior written notice to the Customer. Additionally, OKX has the right to determine the attributable value of any collateral, including eligible fiat, using a market fiat exchange rate selected solely by OKX.

Forced Loan Repayment / Credit Line Liquidation Rules

When the MR% of a Risk Unit is equal to or lower than 15%, forced repayment of the loans associated with that Risk Unit is triggered (for Institutional Loan, this is referred to as Forced Loan Repayment, note that this is different to the forced repayment that can be triggered as a result of negative balances existing or platform limits being met; for Credit Line, this is referred to as Credit Line Liquidation).

Forced Loan Repayment / Credit Line Liquidation is carried out as follows:

Steps | Example |

1. Freeze borrower's accounts: Freeze all master and sub-accounts within the Risk Unit. Freezing results in the inability to transfer, trade, or withdraw all assets within the Risk Unit, until Forced Loan Repayment / Credit Line Liquidation is complete. | - |

2. Funding Account Repayment: Funding accounts will be utilised for Forced Loan Repayment / Credit Line Liquidation , ahead of trading accounts. Of the accounts within a Risk Unit, they are ordered for Forced Loan Repayment / Credit Line Liquidation from highest to lowest, based on the total USDT value of assets within each account. Thereafter: 1. Within each account, assets and liabilities with the same currency are offset; 2. If liabilities remain, then assets are sold off to repay them. When selecting the cryptocurrency to be sold, assets with the least discount (for reference only, please refer to the Discount Rates table here) are typically prioritized for sale, in an effort to minimise the impact on the user's overall account equity. Assets with a Discount Rate of 0 will not be sold. Among assets with identical Discount Rates, assets with better liquidity are prioritized. Assets are first converted to USDT, then to the currency in which the liability is. USDT is used as an intermediate conversion asset due to its high liquidity and low slippage. Liquidity rankings are dynamically adjusted based on OKX Platform liquidity, and are not publicly disclosed; 3. Sold assets are used to repay liabilities, with loans in the most illiquid currencies being prioritized for repayment first. | Assume that an account has: A liability of 10 BTC; Assets of 4 BTC; Additional ETH and SOL assets. As an example of the same currency offset mechanism, the BTC assets are used for repayment, and a net 6 BTC liability remains; As an example of repayment using liabilities and assets of different currencies, if the account continues to have a liability of 6 BTC, but no BTC assets, other assets are used. If the account has ETH and SOL, then ETH would be prioritised for sale. The ETH would be converted to USDT, and then again converted to BTC to pay off the remaining 6 BTC liability. |

3. Trading Account Repayment: In the event that liabilities still remain in the Risk Unit after the above, then trading accounts are utilised for Forced Loan Repayment / Credit Line Liquidation . At the outset, all pending orders in a Risk Unit are cancelled. Of the accounts within a Risk Unit, they are ordered for Forced Loan Repayment / Credit Line Liquidation from highest to lowest, based on the maintenance margin ratio of each account. Thereafter: 1. Within each account, assets and liabilities with the same currency are offset; 2. If liabilities remain, then assets are sold off to repay them. When selecting the cryptocurrency to be sold, assets with the least discount (for reference only, please refer to the Discount Rates table here) are typically prioritized for sale, in an effort to minimise the impact on the user's overall account equity. Assets with a Discount Rate of 0 will not be sold. Among assets with identical Discount Rates, assets with better liquidity are prioritized. Assets are first converted to USDT, then to the currency in which the liability is. USDT is used as an intermediate conversion asset due to its high liquidity and low slippage. Liquidity rankings are dynamically adjusted based on OKX Platform liquidity, and are not publicly disclosed; 3. Sold assets are used to repay liabilities, with loans in the most illiquid currencies being prioritized for repayment first; 4. For each account / sub-account, initially, assets are sold and liabilities repaid to bring each account / sub-account within the Risk Unit to its IMR. 5. If liabilities still exist, then assets in each account / sub-account will continue to be sold and liabilities repaid to bring each account / sub-account within the Risk Unit to its maintenance margin ratio (MMR) (or a specific percentage of the maintenance margin ratio); 6. If the borrower then continues to have a liability, then then forced liquidation based on unified account liquidation rules will occur, as explained in this article. | Assume that after the above mechanism: 1. The account has a remaining liability of 5 BTC; 2. Sub-account A has assets of 1 BTC, and its IMR is 0.8 BTC, and its MMR is 0.5 BTC; 3. Sub-account B has assets of 1 ETH, and its IMR is 0.8 ETH, and its MMR is 0.5 ETH. The repayment process would be as follows: 1. First, all pending orders in all trading accounts are cancelled; 2. Next, 0.2 BTC is transferred from sub-account A to OKX, in order to repay the loan up to the IMR of that sub-account. The residual liability is 4.8 BTC; 3. Thereafter, 0.2 ETH is transferred from sub-account B to OKX, in order to repay the loan up to the IMR of that sub-account. The 0.2 ETH is converted to USDT and then to BTC. Assume this results in 0.05 BTC. The residual liability is 4.75 BTC. 4. Given that 4.75 BTC of liability remains, forced liquidation based on the unified account liquidation rules would now occur. |

Note however that if forced liquidation occurs or is ongoing, for a specific account / sub-account based on unified account liquidation rules, then Forced Loan Repayment / Credit Line Liquidation as described above will not occur on such account / sub-account.

Forced Loan Repayment / Credit Line Liquidation is complete when the Total Liability of the Risk Unit is fully repaid. If the Total Liability of the Risk Unit is fully repaid, then the accounts / sub-accounts within the Risk Unit are automatically unfrozen. However, if that Total Liability is not fully repaid, then the accounts / sub-accounts will continue to be frozen. If there continue to be liabilities in the Risk Unit after liquidation, this will be shown on the Platform, and the user will continue to be liable for such amount.

A liquidation fee is charged upon liquidation, calculated as follows:

(a) total amount of assets that have successfully been liquidated x Taker fee rate of the borrower's current fee tier; plus

(b) 2% of the total amount of the Total Liabilities of the Risk Unit (on each asset constituting a liability).

Any residual assets remaining after all liquidation processes are complete will be repaid to the user's main funding account.