Trump’s Crypto Strategy: Regulation, Stablecoins, and Bitcoin Policy

Welcome to our Institutional Top of Mind with 10x Research, with our Macro Shifts series examining the forces reshaping the crypto landscape in 2025. Each analysis offers institutional investors a data-driven perspective on the regulatory environment, political influences, market infrastructure development, and macroeconomic drivers that matter most. Join us as we analyze these macro shifts through an institutional lens, providing deeper insights for sophisticated market participants navigating this rapidly evolving space.

In our third installment, as the Trump administration takes decisive action on crypto policy in early 2025, 10x Research analyzes the implications of his executive order banning CBDCs and mandating new regulations. We dive into how key appointees David Sacks and Scott Bessent are steering the U.S. toward a pro-crypto stance that could reshape digital asset markets through stablecoins and potential Bitcoin reserves.

TLDR:

Trump's Crypto Executive Order (Jan 23, 2025): Revokes Biden-era policies, bans a U.S. CBDC, and mandates a 180-day deadline for a new crypto regulatory framework.

David Sacks’ Crypto Strategy: Leads a task force to develop fair banking access for crypto firms, explore a U.S. Bitcoin reserve, and push stablecoin adoption to boost U.S. Treasuries.

Scott Bessent’s Economic Stance: Opposes CBDCs, supports Fed independence and the U.S. dollar’s reserve status, and warns of economic risks if the 2017 tax cuts expire.

Crypto Market Impact: First progress reports due Feb 23 & May 2, with a final framework by July 24, 2025; Bitcoin may benefit from pro-crypto policies, lower yields, and inflation control.

President Donald Trump has launched significant crypto regulatory actions early in his second term, starting with the Strengthening American Leadership in Digital Financial Technology executive order, signed on January 23, 2025. This order revokes previous directives from the Biden administration, explicitly bans the creation of a U.S. Central Bank Digital Currency (CBDC), and establishes a 180-day deadline for federal agencies to develop a comprehensive crypto regulatory framework.

President Donald Trump has initiated significant actions concerning cryptocurrency regulation early in his second term. The Strengthening American Leadership in Digital Financial Technology order, signed on January 23, 2025 revokes Executive Order 14067 (March 9, 2022) and the Department of the Treasury's Framework for International Engagement on Digital Assets (July 7, 2022), effectively rescinding policies and directives from the previous administration. It explicitly prohibits the establishment, issuance, or promotion of any U.S. CBDC. A group led by the White House's newly appointed "AI and Crypto Czar," David Sacks, has been established. This group includes leaders from the Treasury Department, Justice Department, and Securities and Exchange Commission (SEC). They are tasked with proposing a federal regulatory framework for digital assets within 180 days.

The executive order mandates that, within 30 days, the Treasury Department, Justice Department, SEC, and other relevant agencies identify all existing regulations, guidance documents, and orders affecting the cryptocurrency sector. While the executive order sets a 180-day deadline for comprehensive policy proposals, it is anticipated that preliminary recommendations and potential legislative drafts will emerge within the first 100 days. These are expected to focus on:

Developing policies to guarantee that cryptocurrency businesses have fair access to banking services

Exploring the creation of a strategic Bitcoin reserve to bolster national interests and

Forming a council to provide ongoing guidance on cryptocurrency-related matters.

In early February, David Sacks (Crypto Czar) held a press conference to outline the administration's strategic initiatives in the cryptocurrency sector. He emphasized the transformative potential of stablecoins, stating they could bolster the U.S. dollar's international dominance and significantly increase demand potentially trillions of dollars of demand for U.S. Treasuries, which could lower long-term interest rates. He announced a collaborative effort between the Agriculture and Finance/Banking Committees of both the Senate and House to develop comprehensive digital asset legislation. Senator Tim Scott, Chair of the Senate Banking Committee, expressed optimism about the progress, aiming for the legislation to be ready for President Trump's signature within 100 days.

Sacks highlighted the need for clear regulations to foster innovation within the U.S. and prevent the offshoring of crypto activities, which can complicate regulatory oversight and consumer protection. Addressing questions about a potential Bitcoin Reserve, Sacks confirmed that the administration is evaluating the concept.

Scott Bessent, the newly confirmed U.S. Treasury Secretary, has recently made several notable statements and actions regarding Bitcoin and cryptocurrencies that confirm the administrations coordinated stance toward crypto and stablecoins. During his Senate Finance Committee hearing on January 16, 2025, Bessent expressed his opposition to the U.S. issuing a CBDC, stating, "I see no reason for the U.S. to have a central bank digital currency." He further elaborated that CBDCs are typically pursued by countries lacking other investment alternatives and are "doing it out of necessity."

Bessent emphasized the importance of maintaining the Federal Reserve's independence, asserting that the central bank should operate without political interference. He expressed confidence that inflation would align with the Federal Reserve's targets, stating that he expects inflation to "come back into line with the Fed's target." Bessent affirmed his support for the U.S. dollar remaining the world's reserve currency. He stated, "The dollar should remain the world's reserve currency," underscoring the importance of the dollar's central role in global finance.

Addressing concerns about the national debt, Bessent highlighted the need for fiscal responsibility. He warned that allowing the 2017 tax cuts to expire would result in a significant tax increase, potentially leading to an "economic calamity." He emphasized the urgency of extending these tax cuts to prevent adverse economic consequences.

Progress reports on digital assets are expected on February 23 and May 2, with the six-month deadline approaching on July 24, 2025. The administration appears committed to establishing a structured yet deliberate approach to regulating digital assets, ensuring that crypto firms gain access to proper banking relationships to operate within a clear legal framework.

Additionally, the administration's focus on lower bond yields and reducing inflation should provide a supportive backdrop for Bitcoin’s price. As wealth creation accelerates, demand for alternative assets like Bitcoin is likely to persist, reinforcing its role in an evolving financial landscape.

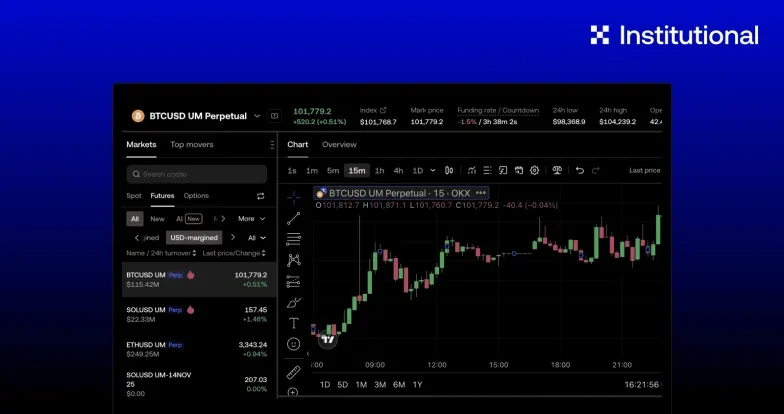

OKX conversation on Telegram

For the latest insights, updates, and announcements beyond what's included in our bi-weekly newsletter, head over to our OKX Institutional Telegram channel.

As a private, members-only group, our Telegram channel allows for real-time dialogue where we can discuss and share market coloring, product roadmaps, and more with our valued institutional clients and partners.

Disclaimer: This publication is issued in 10x Labs Limited (“10x Research”). The information provided in the publications are meant purely for informational purposes and should not be relied upon as financial advice. None of the information contained here constitutes an offer, or a solicitation of an offer, to purchase or sell any securities, financial instruments or strategies, or to make any investments. Any opinions expressed are intended to be mere opinions and not investment advice, and nothing herein should be construed as financial, investment, legal or tax advice or advice of any sort. 10x Research does not provide individually tailored investment advice. You are advised to consult with your own professional advisers and to make your own independent decisions regarding any securities, financial instruments, strategies or investments. Any opinions are personal to the author and may be subject to change. These may not necessarily reflect the opinion of 10x Research or its affiliates, officers or employees. This publication has been prepared based upon information, including market prices, data and other information, from sources believed to be reliable and we make no representation and assume no liability as to the accuracy or completeness of the information nor for any loss arising from any investment made in reliance of this publication. This publication may contain data from third party sources and may contain inaccurate or out-of-date data. The analysis of political events and their potential impact on digital assets is speculative and should not be considered definitive or predictive. Investment in digital assets carries a high level of risk and may lead to a total loss of capital. To the extent applicable, 10x Research asserts legal ownership and copyright over this publication. This publication may not be used, redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of 10x Research. Any unauthorized use is prohibited. Receipt and review of this information constitutes your agreement not to use, redistribute or retransmit the contents and information contained in this publication without first obtaining express permission from an authorized officer of 10x Research. Copyright 2025 10x Labs Limited. All rights reserved.

© 2025 OKX. This article may be reproduced or distributed in its entirety, or excerpts of 100 words or less of this article may be used, provided such use is non-commercial. Any reproduction or distribution of the entire article must also prominently state: “This article is © 2025 OKX and is used with permission.” Permitted excerpts must cite to the name of the article and include attribution, for example “Article Name, [author name if applicable], © 2025 OKX.” Some content may be generated or assisted by artificial intelligence (AI) tools. No derivative works or other uses of this article are permitted.